When Life Gives You Lemons…

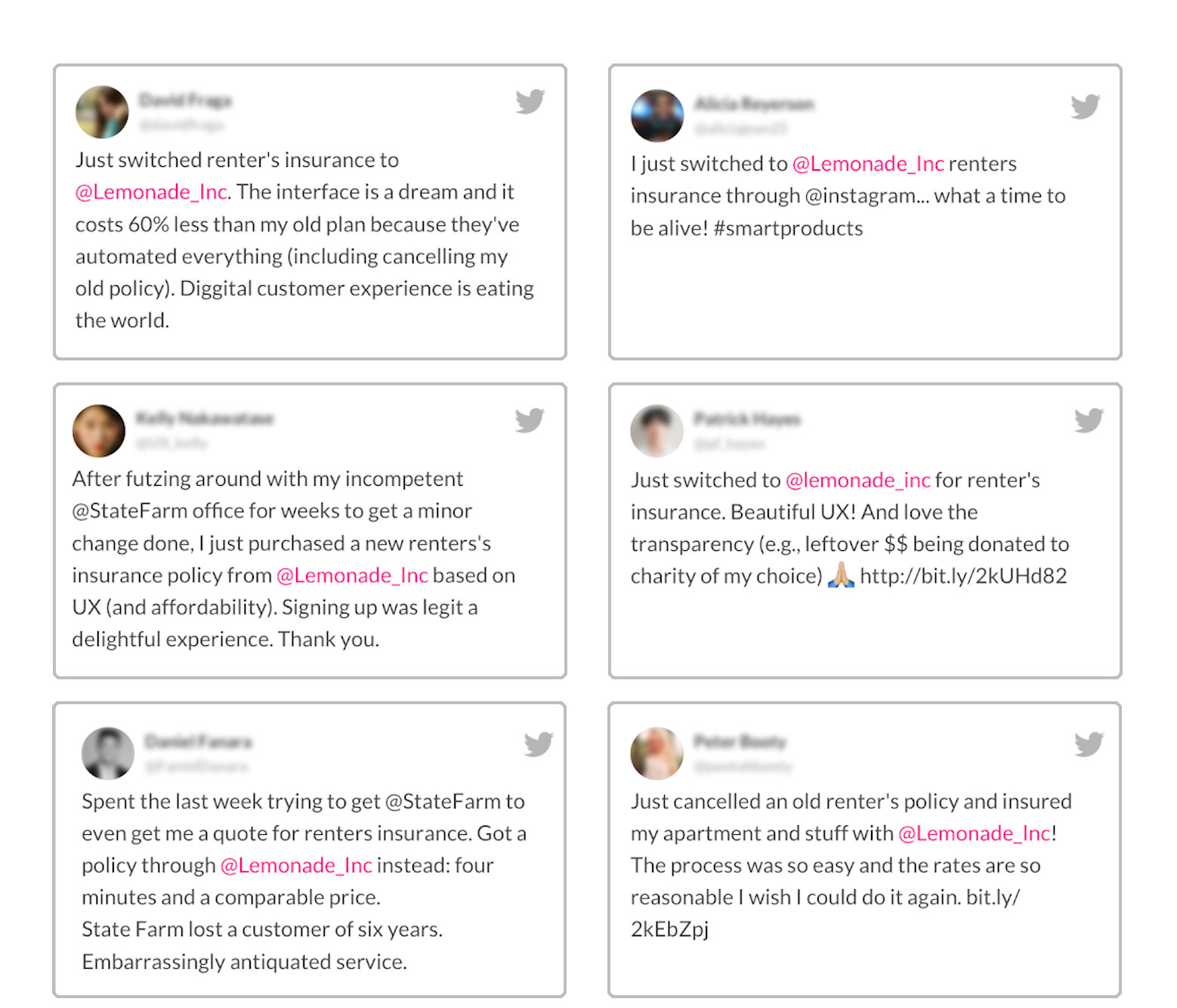

Having to pay for homeowners insurance month after month leaves a sour taste in most people’s mouths. Lemonade, an app-based homeowners and renters insurance company, is trying to turn that lemon into something sweet by simplifying the insurance process. Insuring your home or apartment through Lemonade is meant to be fast, easy, affordable, and (dare we say) even a little enjoyable. For many customers, that rings true.

Read our full review of Lemonade Insurance

Who Is Lemonade Insurance For?

Lemonade states loud and clear on its site that it offers “homeowners and renters insurance for urban dwellers.” Dig in a little more and you’ll find that “urban dwellers” points toward younger homeowners and renters — people with basic coverage needs and a craving for tech-friendly, digital-first insurance. Low cost doesn’t hurt, either.

“As a [real estate] agent, I have been extremely satisfied with Lemonade’s insurance offerings, especially when it comes to tenants obtaining insurance,” says Jennifer Okhovat, a Realtor at Compass in Los Angeles, California. “Many landlords now require tenants to carry renters insurance, and Lemonade makes it quick and easy for tenants to sign up for a policy within minutes.”

Image: Twitter via Lemonade

Of course, Lemonade isn’t the right choice for all homeowners and renters. Rates are highly dependent on location, value of the home, and potential risks (like earthquakes, flooding, or fire). That means Lemonade’s pricing wont be competitive for everyone.

For example, Nick Haschka, Founder and COO of Credit Parent, says, “I shopped for Lemonade a few months back. Their quote process was slick. It was fast and easy to get a price, but their pricing was 35% above what I was paying with AAA of Northern California for a higher deductible and less overall coverage, so I stayed put.”

Finding the right homeowners insurance company for you means checking coverage options and comparing quotes from multiple insurers. If Lemonade offers you the best value on the coverage you need, it’s a great choice. If not, you’ll want to check our best home insurance companies picks.

How Lemonade Insurance Works

At its core, Lemonade does the same thing as any other homeowners insurance company: It settles claims to help repair or replace your home and belongings if something bad happens. Homeowners and renters are covered against all the standard “perils” with Lemonade, including theft, damages, and liability, and can add extra coverage for valuable belongings — but that’s where the similarities stop.

Lemonade operates completely differently than a “normal” insurer. Though the company doesn’t use these exact words, it’s essentially a peer-to-peer or “P2P” business. P2P scraps the traditional profit-driven insurance model, where providers collect excess premiums (in other words, unpaid claims) as revenue. Instead, Lemonade policyholders insure one another.

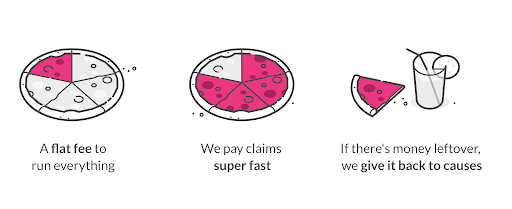

It works like this: If you insure your home or apartment with Lemonade, premiums you pay to the company are pooled with other homeowners or renters (your “peers”). Lemonade takes a flat fee of about 20% out of that pool, which pays for operating costs and reinsurance. If anyone in your group makes a claim, money is paid out from the pool to repair their home or replace belongings. At the end of the year, leftover premiums are donated to a charity of your pool’s choosing. This is what Lemonade calls its “Giveback” policy.

Image: Lemonade

Part of the reason Lemonade’s model works is that it’s completely digitized. Lemonade doesn’t operate any physical agencies or write policies through agents. Instead, customers apply, buy, and file claims online or through the mobile app. This keeps overhead costs lean and lets Lemonade put the majority of proceeds toward claims and Giveback. It also helps keep premiums low, with home insurance starting at just $25 per month and renters insurance at $5 per month. (Of course, prices vary widely by customer and location.)

Many people will find Lemonade’s digital-first attitude refreshing. It tends to be faster, easier, and more straightforward than the traditional insurance-buying process. However, this type of communication doesn’t work for everyone. If you have complex home insurance needs, want help finding a great bundling deal, or simply aren’t comfortable buying insurance online, you might prefer a company with more hands-on customer service.

Lemonade’s Giveback Program

Lemonade’s progressive Giveback program earns the company major points. “Perhaps the biggest difference between Lemonade and other insurance carriers is that Lemonade is a B-corporation,” says Virginia Hamill, Senior Insurance Analyst at FitSmallBusiness.com. “That means it’s been certified by B Lab for meeting certain standards of transparency, accountability, and social and environmental performance.”

For customers, Giveback might reduce some of the pain of their monthly insurance bill. Rather than hard-earned dollars disappearing into the void, policyholders know that what’s not used for overhead or claims will go to a cause they care about. In Lemonade’s P2P model, “peer” groups are based on the participants’ charity of choice.

“We recently announced our 2019 giveback, where policyholders gave back $631,540 to 26 nonprofit organizations they chose across the world.”

Yael Wissner-Levy

VP of Communications at Lemonade

Lemonade’s 2019 Giveback more than triples its 2018 donation of $162,135. It also shows over 1,000% growth from the company’s first Giveback of $53,174 in 2017.

Giveback doesn’t just give customers the warm-fuzzies, either. It also increases transparency about where the company’s profits are going and disincentivizes Lemonade from denying claims.

To be clear, we don’t mean to say that all other insurers are purposely withholding claims to increase profits. Lemonade’s Giveback model just adds an extra layer of clarity to the process. “Unlike traditional insurance companies,” says Lemonade, “we’re not in conflict with our customers, so we’re happy to pay claims fast and with no hassle.”

Filing Claims with Lemonade

Speaking of claims, Lemonade has taken steps to digitize the homeowners insurance claims process. Instead of an insurance adjuster coming to your home, assessing damages, and processing the claim over an extended period of time, many Lemonade claims are processed and paid directly through the company’s mobile app.

If you’re having trouble imagining how a home insurance claim could be processed with AI, you’re not alone. We had Lemonade explain it to us in layman’s terms.

“Our claims process is handled by AI Jim, our claims bot. Anything that is not considered an emergency or is ongoing can be handled by AI Jim, allowing Lemonade to be able to pay claims in seconds. This allowed us to break a world record … and review, approve, and pay a claim instantly,” says Wissner-Levy.

She continues, “Today, 30% of our claims are paid with no human involved (in 2018, our bot AI Jim paid $1 million in claims with no human involvement). We have 18 anti-fraud algorithms that we run with every claim, and we have a team of highly talented insurance executives monitoring the claims handling and payment.”

In other words, Lemonade cedes to traditional insurance practices a bit when it comes to claims. Rapid settlements for minor claims are great, but it’s also nice to know that live insurance professionals have your back when it comes to the complicated stuff.

Note: Claims can only be filed through Lemonade’s mobile app, not on the company’s website or over the phone. For this reason, Lemonade users must have a smartphone.

What’s Next?

- Read our full review of Lemonade Insurance

- Explore other top home insurance companies

- Learn how much home insurance you need