We recommend products and services based on unbiased research from our editorial team. We make money via affiliate links, which means if you click a link on our site, we may earn a commission. Any commissions we receive do not affect our recommendations; if you want to know more about how that works, read more.

MassMutual Life Insurance Review

Massachusetts Mutual Life Insurance offers term, whole, and universal life insurance policies, plus annuities and 401(k)s for individuals and businesses who want to provide group life insurance benefits for their employees. It also offers a no-charge LifeBridge insurance plan to eligible parents that provides a 10-year, $50,000 policy for your child’s education should you pass away, plus a term life option that does not require a medical exam.

MassMutual is ideal for individuals who would prefer to manage their life insurance and retirement planning all in one place, with a company that earns high financial strength ratings. MassMutual’s policies are a little less flexible than those of some other companies, with term insurance starting at a fairly high $100,000 and fewer coverage add-ons. It’s still worth including in your quote-gathering, but it may not be the best option if you need more specialized insurance.

The Life Insurance Factors We Analyzed

Customer experience

MassMutual received a rating of three out of five stars in J.D. Power’s life insurance customer satisfaction survey. It’s not a terrible score by any stretch, though the company does sit below industry average — likely because it only scored two out of five in the “price” category. With that said, the insurer received fewer than average customer complaints in 2018, according to the National Association of Insurance Commissioners, so you may have a fine experience with the company as a whole.

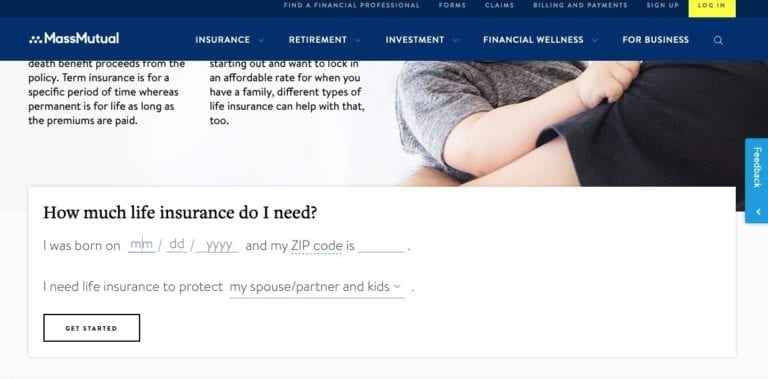

As with many insurance companies, you’ll have to call the company to get a quote for most products, although you can apply for MassMutual’s no-exam Direct Term option online. Once you have a policy, the online portal makes the experience even easier, allowing you to manage your life insurance policies and retirement investment products all from the same place — just note that while MassMutual’s Apple app adds even more convenience, the Android app is poorly reviewed.

Coverage and rider information

While MassMutual stands out for some of its unique coverages, like long-term care coverage that is bundled with a life insurance policy, it has fewer policy add-ons than other top companies like New York Life, State Farm, and Northwestern Mutual. These optional coverages, or “riders,” allow you to customize your life insurance and add extra financial protection in case of injury, disability, or long-term illness. MassMutual doesn’t advertise many riders on its website; it’s missing options like spouse and child insurance riders, an accidental death rider, and a critical illness rider.

However, just because MassMutual isn’t the most customizable doesn’t mean it can’t offer you a good policy. It stands out in particular for its Direct Term policy, which can be purchased without the need for a medical exam — a great option for people with preexisting conditions — with death benefits ranging from $100,000 to $3 million. Its regular term life policies can also be converted into permanent policies without an additional medical exam, so you have the security of staying with the same company if you decide you need more coverage down the line.

Life insurance coverage features

MassMutual Life Insurance Overview: Financial Strength, Availability, and History

MassMutual has been insuring individuals since 1851. It’s an innovator among insurers — it added retirement services and financial planning in the 1950s and was one of the first firms to add universal life insurance in the 1980s. It backs up its history with excellent financial strength, earning high marks from each of the three major independent ratings agencies.

As a mutual company, policyholders are eligible to receive company dividends, and MassMutual has paid out every year since 1869. Policyholders seem generally happy with the company; it received fewer than the average number of complaints in the industry in 2018, and it continues to write a significant number of premiums in the U.S. life insurance market.

- In business since: 1851

- S&P Global financial strength rating: AA+

- Moody’s financial strength rating: Aa3

- A.M. Best financial strength rating: A++

- States served: 50 plus Washington, D.C.

The Competition

All information accurate as of January 2, 2020.

The Bottom Line

MassMutual offers customers a wide range of financial services and products, including annuities, retirement planning, asset management, and life insurance products. It consistently performs well in financial strength and customer service ratings, and its no-exam term life policy is worth looking into for customers with preexisting conditions. MassMutual doesn’t offer the most customizable policies, with fewer add-on coverage options than many of its competitors, but it could be worth calling for a quote to see what it can offer you.